INVESTMENTS

How we help you invest

With a wealth of experience in constructing investment portfolios, Anchor Wealth excels in the art of curating professionally managed investment funds. These funds unite the resources of numerous investors to collectively acquire securities, generating a synergistic approach to wealth building.

Anchor Wealth is dedicated to matching individuals with the ideal product provider aligned with their unique goals. This involves collaborating with diverse fund managers, resulting in the development of meticulously diversified portfolios. These portfolios encompass a spectrum of investment opportunities, including Shares, ETFs, SMAs, LICs, listed property (REITS), unlisted property, and Fixed interest.

Within our offerings, you will find two distinctive investment portfolio avenues:

Managed Funds (bundled structure): This entails a comprehensive investment package, intricately woven together to optimise returns and mitigate risks.

Wrap investment accounts (unbundled structure): Offering an unprecedented level of flexibility, this approach empowers clients with the freedom to select individual investments tailored to their preferences.

Both investment vehicles serve as more than just financial instruments. They extend an administrative service, allowing clients to hold a diverse array of investments securely. Furthermore, these avenues open doors to investments that might have otherwise been inaccessible due to high initial investment requirements.

At Anchor Wealth, our commitment lies in crafting investment portfolios that transcend traditional limitations, enabling our clients to embark on a journey towards financial growth and security.

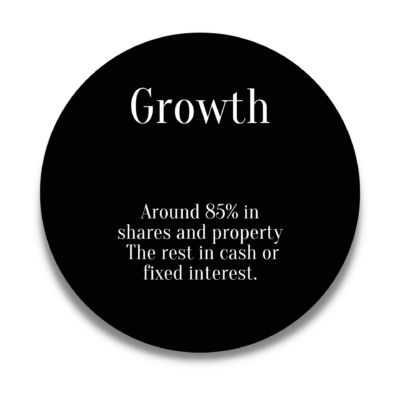

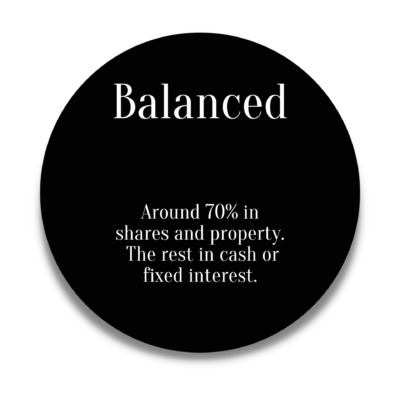

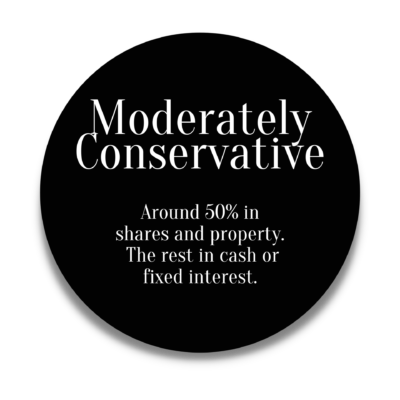

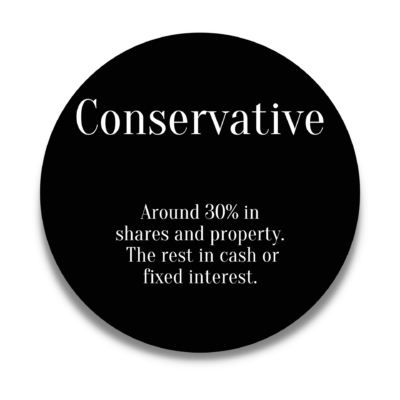

Investors can choose the following Investment mix depending on their needs, investment goals and expertise.

Asset classes available to invest IN

Shares

The prospect of outright purchasing major corporations like Commonwealth Bank, BHP, Woolworths, or Apple may be beyond the financial reach of most individuals. However, a viable alternative exists. Entering the marketplace and acquiring fractional ownership in these enterprises through the acquisition of “shares.”

Engaging in long-term share investing entails becoming a partial owner of these prominent businesses. This ownership not only allows individuals to reap the rewards of these companies’ sustained growth over time but also positions them to receive a share of the potential income distribution payments that these businesses generate in the form of dividends.

In essence, this approach empowers investors to forge a lasting connection with the prosperity of these corporations, all while benefiting from the potential financial gains they can offer.

Property

REITs listed property

Real Estate Investment Trusts (REITs) extend an invaluable opportunity to the average investor, providing a gateway to the expansive realm of the property market. This avenue empowers investors to partake in the property market’s potential without necessitating substantial deposits or significant financial commitments.

By engaging with REITs, investors effectively secure a stake in the property market through the avenue of share investing. This strategic approach aggregates multiple investors’ resources, enabling access to the domain of commercial property that would otherwise remain beyond the reach of the average investor.

In essence, REITs offer a means to diversify one’s investment portfolio while simultaneously affording exposure to the multifaceted benefits of the property market. This novel approach democratises property investment, offering a slice of the market’s potential without the barriers that traditionally accompany direct property ownership.

Unlisted property

Professionally managed unlisted property trusts present an alternative avenue for investing in property, offering distinct advantages over traditional methods.

Unlike holding shares in a listed Australian real estate investment trust (A-REIT), unlisted properties within these trusts grant investors direct ownership of property assets. This departure from the share-based model provides a tangible connection to real property ownership.

A distinctive characteristic of unlisted property lies in its absence from the share market. As its name implies, unlisted property avoids exposure to the volatile nature of the market, offering investors a shield against the unpredictable swings of market sentiment.

In contrast to listed vehicles like REITs, the returns of unlisted property trusts exhibit less correlation with day-to-day share market fluctuations. This reduced volatility in unit prices reflects the intrinsic value of the underlying assets, leading to a more stable investment environment.

A noteworthy attribute of Australian unlisted property trusts is their capacity to facilitate investment in substantial commercial assets, such as expansive shopping centres and industrial properties. This unique accessibility to sizable assets positions individual investors to partake in opportunities that would otherwise be beyond their independent reach.

Unlisted property trusts serve as a collective mechanism, allowing investors to pool their resources to acquire substantial commercial properties that might be unattainable as standalone investments. Mirroring the model of REITs, unlisted property trusts extend a path for retail investors to engage with substantial assets like shopping centres and CBD office towers through a collective vehicle.

An essential distinction lies in the debt structure within unlisted property trusts, which remains at the fund level and carries no recourse to individual investors. This implies that investors’ financial liability is limited to their initial investment.

Distinguished by their inclusion of high-quality properties leased on long-term agreements, unlisted property trusts offer stability in returns, with the potential for appreciating capital value. These attributes make them a preferred choice for major institutions, including super funds and diversified investment portfolios.

Moreover, unlisted property trusts function as pivotal cornerstones in a diversified portfolio, contributing diversification benefits and consistent income streams with low correlation to listed investments.

Notably, unit holders in these trusts share in the capital gains upon the disposal of an asset, amplifying the potential for wealth accumulation.

Fixed interest

When both government entities and large corporations seek to raise capital, a viable avenue is to secure funds from investors. In exchange, these investors are entitled to an interest-based compensation, which can either be at a consistent rate or variable throughout the loan’s duration.

This setup is underpinned by the notable probability of minimal instances where governments or well-established corporate entities default on their repayment obligations. As a result, this approach is regarded as a relatively secure option within the sphere of short-term asset classes.

However, it’s worth noting that the potential returns associated with this strategy are relatively modest compared to alternative investment asset classes. This is primarily due to the investors’ limited exposure to short-term market fluctuations and associated risks.

At the heart of this landscape are fixed interest instruments, with bonds being the prevailing manifestation. Bonds take on two principal forms: government bonds and corporate bonds. While the anticipated returns from this avenue might be conservative, its merits to an investor’s portfolio are substantial, notably in terms of diversification.

In essence, fixed-interest investments, with their inherent stability and diversity-enhancing attributes, provide a thought-provoking and astute addition to an investor’s financial strategy.

Simply fill in your details below and get this report sent straight to your inbox.

This exclusive report reveals.

What you will miss not reading this report

You're probably thinking

We assist individuals at different stages of life and income levels.

We’re here to tell you THOUSANDS OF Australians are receiving financial advice every year WITHOUT PAYING a single dollar out of pocket.

Do not miss out on your financial goals, claim your video strategy session to understand how you can too.

We’re here to tell you and show you this is not the case long term.

Understanding this is vital. In addition, how we build your investment portfolio is 100% based on your level of comfort after we educate and guide you.

You can invest conservatively or take on more growth assets.

Ask yourself this simple question, are the individuals you are speaking to providing you informed advice, or simply offering you an opinion?

Are they in a position of working because they choose to, or because they have to?

What assets have they acquired.

In other words don’t follow the herd, Act now and make an informed decision and start your journey.

Consider your family and friends, have they ever had a relationship with a Senior Financial Advisor.

Assess which family and friends are working because they choose to, and not because they have to. People are not aware of what they do not know. It is that simple.

Often people delay financial decisions due to not knowing who to turn to, where to start and who to trust.

We’re one of Australia’s fastest growing financial planning businesses, operating under our national licensee group lifespan stringent compliance and advice processes. lifespan is one of the largest licensee groups in Australia.

Our Audit compliance record is an astonishing (A) rating. This is something we are extremely proud of in our highly regulated industry.

Further, if you scroll below read the many positive client reviews and the recognition of Milad Rezaei on the “best financial planners” Australia website.

We’re here to tell you that is like saying I need to know how to build a car before I drive, or I need to know how to build a house before I live in one.

We will walk you through the fundamentals, explaining where the benefits are derived from, allowing you to understand the important facets.

We take care of the HOW at our end, allowing you to get on with your life.

We’re here to tell you the structures we implement allow investors to contribute, drawdown, pause contributions, close the account within a few business days, and without penalty.

It can be tailored to where you are at in life seamlessly.

Having your funds inaccessible is pointless and we understand that

We provide the hand holding and the implementation, allowing you to get on with your busy life.

All you are required to understand are the benefits and basic fundamentals. We get this information across over multiple video and phone calls as required.

We provide guidance to individuals from diverse life stages and income brackets. The key drivers in investment success are time and the magic of compound interest.

We are here to demonstrate that the long-term perspective tells a different story entirely.

This comprehension is of utmost importance. Moreover, the construction of your investment portfolio hinges entirely on your comfort level, which we cultivate through education and guidance.

You have the option to opt for a conservative investment approach or embrace a portfolio with a greater emphasis on growth assets.

We want to highlight that THOUSANDS OF Australians are benefiting from financial advice each year WITHOUT incurring any out-of-pocket expenses.

Don’t let your financial aspirations slip away; secure your video strategy session now to discover how you can do the same.

Consider this straightforward query: Are the individuals you’re conversing with providing you with well-informed guidance, or are they merely sharing their opinions?

Are they engaged in their work out of choice, or out of necessity? What assets have they successfully acquired?

In essence, refrain from merely following the crowd. Take proactive steps now to make an informed decision and embark on your unique journey.

Reflect on your circle of family and friends. Have any of them ever engaged with a Senior Financial Advisor?

Examine which among them are actively pursuing their careers by choice rather than necessity. It’s a fact that people are unaware of what they don’t know.

Frequently, individuals postpone critical financial decisions because they grapple with uncertainty about whom to consult, where to initiate their journey, and whom to place their trust in.

We take pride in being one of Australia’s most rapidly growing financial planning enterprises, operating under the esteemed national licensee group, Lifespan, renowned for its rigorous compliance and advisory protocols. Lifespan holds a distinguished position as one of the largest licensee groups in Australia, having received numerous accolades as the best licensee group in the country over the years. For further substantiation of these achievements, we encourage you to visit their website.

It’s important to note that every Anchor Wealth plan undergoes a thorough evaluation by Lifespan before being presented to our valued clients. Once Lifespan is fully satisfied with the quality of advice and recommendations, Anchor Wealth financial planners are granted the green light to share the plan with clients. This rigorous screening process serves as an additional layer of security, greatly reassuring most of our clients.

Moreover, if you peruse the testimonials below, you’ll find an array of positive client reviews. Additionally, our very own Milad Rezaei has earned recognition on the “Best Financial Planners” Australia website.

We’re here to dispel the notion that embarking on an investment journey necessitates a pre-existing background in Investments or an extensive knowledge base. This belief is akin to suggesting that one must possess partially the skills to build a car before driving it, or that they should be proficient in house construction before residing in one.

Our aim is to guide you through the fundamental principles of investing, elucidating the origins of its benefits, and providing you with a comprehensive understanding of its pivotal aspects.

We handle the intricacies and mechanisms behind investing, leaving you free to pursue your life without being bogged down by the complexities of the process.

We want to emphasize that our investment structures are designed with flexibility in mind. With our approach, investors can easily contribute, withdraw funds, pause contributions, and even close their accounts within just a few business days, all without incurring any penalties.

We recognise that life’s circumstances are ever-changing, and our system can be seamlessly tailored to accommodate your current financial situation. We understand the futility of having your funds locked away, and we are committed to providing you with the accessibility and control you need.

We offer comprehensive support and take care of the implementation process, freeing you to focus on your bustling daily life. Your responsibility is limited to grasping the advantages and fundamental principles, which we convey through multiple video and phone calls as needed. Notably, unlike many financial planning firms, we do not levy extra service fees for implementation, ensuring complete transparency and eliminating any unexpected charges.

Indeed, the prerequisites for commencing an investment portfolio can fluctuate among various product providers, especially between regular master trust investment accounts and wrap investment accounts. However, based on our experience, there are specific providers we’ve engaged with in the past who permit individuals to embark on their investment journey with a modest initial contribution as low as $1,000.00.