Personal insurance should be the fixed cost of your financial plan

Possessing appropriate life insurance stands as a pivotal cornerstone within your family and financial framework. Entrusting your family’s economic destiny to mere happenstance in the face of potential injury, illness, or demise is a risk too grave to entertain.

Safeguard your family’s fiscal trajectory by enacting a comprehensive, enduring life insurance strategy, thoughtfully structured with the guidance of an adept life insurance specialist from Anchor Wealth. Your prudently constructed strategy can be the bedrock that secures your financial future, even in the face of life’s unpredictable twists.

A VITAL DECISION THAT WILL IMPACT THE REST OF YOUR LIFE

LONG-TERM INSURANCE PLANNING

Envision the picture to your right.

A scenario where you’re tasked with placing the tiniest ball into your pocket.

An action that fades from consciousness within minutes.

Now, shift your focus to another figure grappling with a medium-sized ball.

While conceivable, it accompanies a persistent sense of discomfort.

Now, enter a third character challenged with accommodating the giant ball, a task verging on the impossible.

By reaching out to us at your current age, the prospect of life insurance can be proactively harnessed and seamlessly integrated into a financially viable, enduring plan.

While the option to defer this decision for a few years exists, its course takes a marked turn.

The ensuing premiums, potentially hefty and a constant presence, might transform into a daily burden.

However, should the delay be prolonged, similar to the weighty large ball, the life insurance coverage essential for you and your family could, unfortunately, become an aspiration out of reach.

Take a moment to contemplate the ramifications of delaying this pivotal choice.

Its echoes could resonate throughout your entire professional and retirement odyssey, a presence keenly felt.

Please consider the consequences of waiting to make this critical decision, the impact could be felt for the remainder of your working and retirement life.

HOW TO FUND INSURANCE PREMIUMS FROM SUPER

Insurance inside super

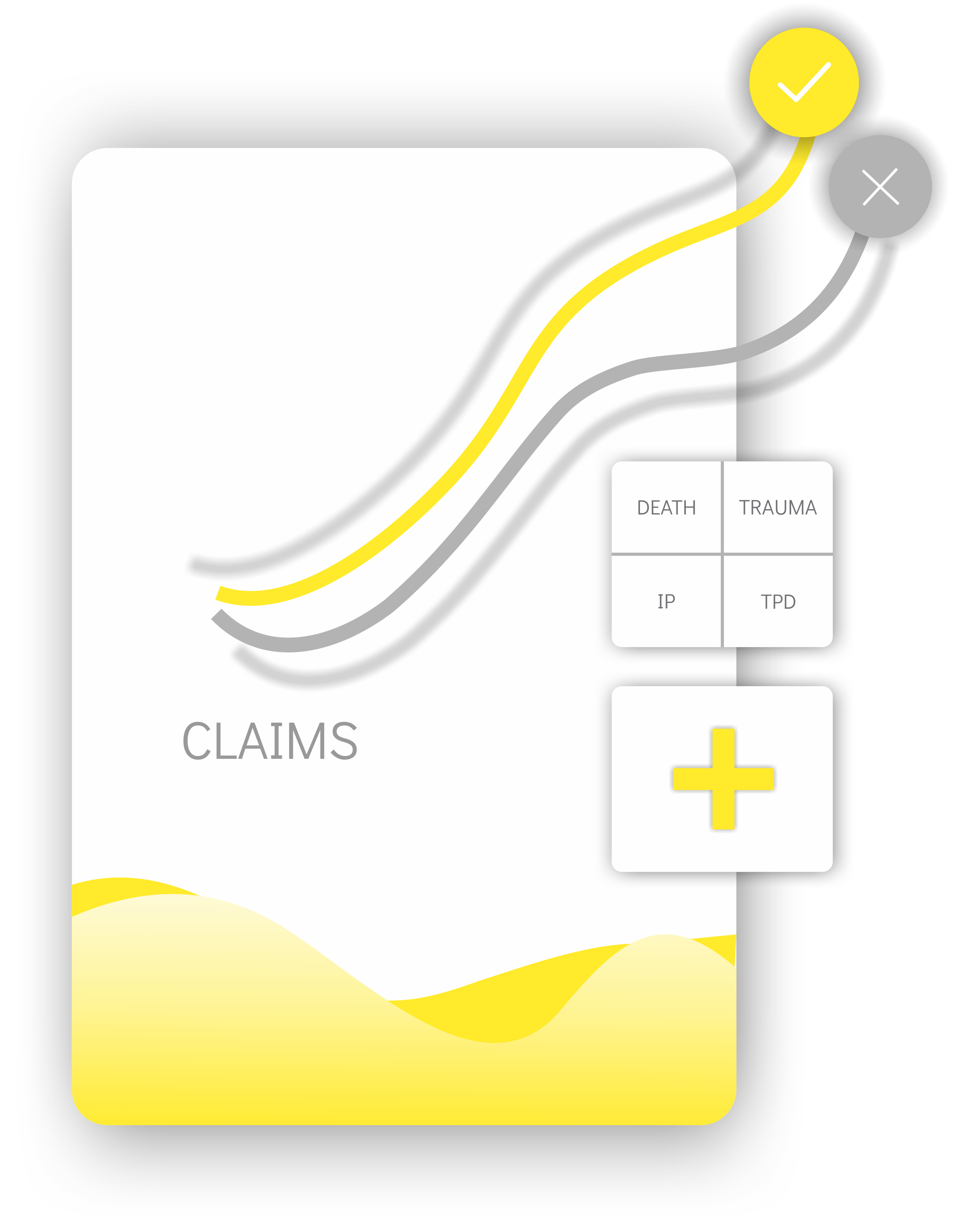

Were you aware that within most super funds, one can hold a trifecta of crucial covers: Death cover, income protection, and total and permanent disablement cover?

The beauty lies in the fact that these premiums are shouldered by the super fund, liberating personal cash flow while furnishing essential safeguards against life’s unpredictable turns. However, a prudent step before delving into this avenue would be seeking astute life insurance counsel.

The prevalence of ambiguous terms and significant omissions in the in-house insurance options provided by Super funds has raised concerns among Australians. Although utilising Super funds to cover insurance premiums offers a financially efficient approach, a more secure solution has emerged.

This involves engaging an external insurance provider exclusively focused on insurance services and integrating it with one’s Super account for premium payments. This strategic shift has proven pivotal in ensuring comprehensive coverage.

However, making the most of this option necessitates expert guidance from a proficient Financial Advisor. At Anchor Wealth, we offer complimentary insurance advice and strategies to individuals who receive Super advice.

WILL IT BE A DISASTROUS OUTCOME WITHOUT COVER?

Why obtain personal insurance

In the expansive realm of insurance, coverage extends to nearly every facet of our daily lives and business endeavours.

Careful consideration is given to the array of options available to address our cover needs, ensuring that even in the face of the unexpected, such as debilitating injuries, prolonged illnesses, or the unfortunate event of mortality, the resulting aftermath for both oneself and one’s family remains a manageable one.

When delving into the realm of personal insurance, a truth becomes evident. For most Australians, there exists no viable substitute. The absence of such covers can potentially lead to dire consequences.

Given the prevalent reliance on a singular family member as the primary provider, it becomes evident that the average Australian household’s financial stability would be severely compromised within a mere month of income loss.

Tragically, in the event of demise, the burden extends beyond financial strain to encompass a substantial economic hardship upon dependents.

Australia currently grapples with historically elevated personal debt levels, ranking among the highest globally. Within this context, the decision to secure personal insurance emerges as a pivotal one, demanding thoughtful contemplation.

Regrettably, insurance cannot be procured at the precise moment it is required. Therefore, an integral aspect of our financial expedition involves proactive planning for unforeseen eventualities. In this narrative, insurance coverage assumes the role of an unwavering cornerstone within one’s financial strategy, eliminating room for chance or uncertainty.

Unfortunately, we cannot obtain insurance when we need it, and as part of our financial journey, future unforeseen planning is essential. Insurance cover can be considered a fixed cost of your financial plan leaving nothing to chance.

HOW LONG CAN YOU LAST WITHOUT AN INCOME?

Income Protection

In the event, you are unable to work due to critical illness or injury we can help you with income protection to cover your income. Generally, 75% of your monthly income is covered for your chosen benefit period to help you pay the bills and maintain your family’s quality of life.

required.

Income protection can:

– Cover daily expenses, i.e. mortgage, bills, food

– Pay for medical costs

Income protection if paid directly can be claimed as a tax deduction and have a benefit period till age 65 if required.

FATAL TRAPS WHEN IT COMES TO LIFE INSURANCE

This FREE Report critical traps to be aware of when considering life insurance

It could save you thousands in the long run and may minimize the chances of a rejected claim, Get your free startling report now.

Don't LEAVE YOUR LOVED ONES WITH THE FINANCIAL BURDEN IF YOU'RE NO LONGER AROUND

Don't LEAVE YOUR LOVED ONES WITH THE FINANCIAL BURDEN IF YOU'RE NO LONGER AROUND

DON’T LEAVE YOUR LOVED ONES WITH THE FINANCIAL BURDEN IF YOU ARE NO LONGER AROUND

Death Cover

With the right amount of Life insurance, you can have the peace of mind knowing that your loved ones will be looked after financially if you were to die or become terminally ill.

Dealing with a loved one’s death is extremely hard, but with life insurance, your beneficiaries will be financially assisted during an extremely difficult time.

MOST AUSTRALIANS KNOW OF SOMEONE WHO HAS SUFFERED AN ILLNESS. SO WHAT HAPPENS TO YOU AND YOUR FAMILY FINANCIALLY WHILST YOU ARE FIGHTING CANCER, RECOVERING FROM A HEART ATTACK OR STROKE?

Trauma cover

How would you or your family cope if you were unable to work for six months or longer, who would pay the bills, will there be someone who can look after the mortgage repayments or the day to day expenses.

Trauma insurance covers you with a lump sum tax-free payment. If you’re diagnosed with a specified medical condition or severe injury or undergo a medical procedure outlined in your policy. This can include heart attack, major organ transplant, cancer, and stroke, to name a few.

ALOT COULD CHANGE IF WE END UP IN A WHEELCHAIR

Total and permanent disablement

Total and permanent disablement cover provides financial assistance if you become disabled and unable ever to work again. This will ensure that you and your family will be able to maintain your quality of life.

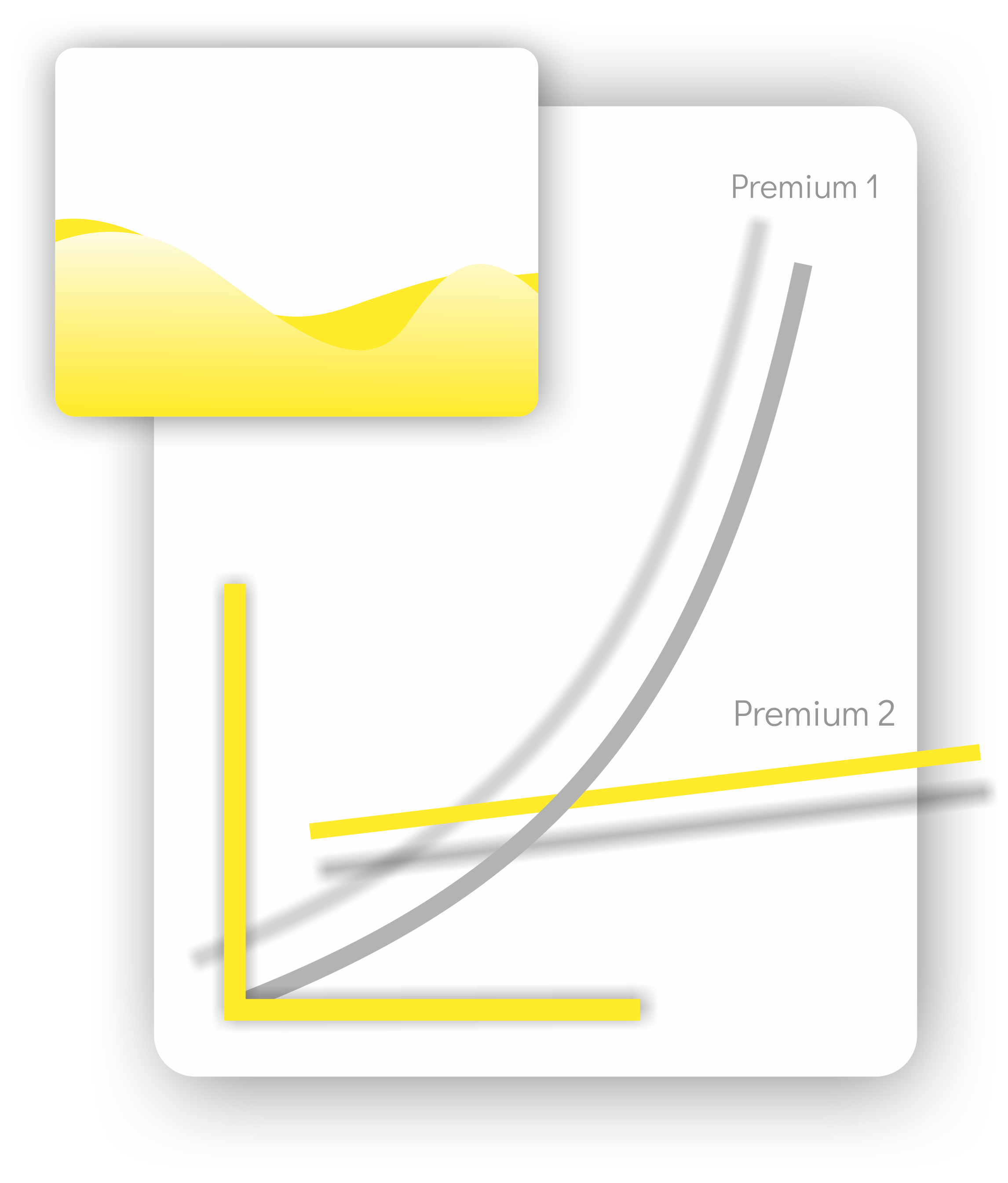

THE PREMIUM STRUCTURE COULD SAVE YOU THOUSANDS IN THE LONG TERM

Understanding the different premium structures when considering life insurance can be critical. The difference could save you a significant amount of premiums in the long term. The cover you desperately need in the later years could still be very affordable by taking up the premium structure that suits your needs. Please seek advice confirming which premium structure is the correct choice for you.

FREQUENTLY ASKED QUESTIONS

We provide guidance to individuals from diverse life stages and income brackets. The key drivers in investment success are time and the magic of compound interest.

We are here to demonstrate that the long-term perspective tells a different story entirely.

This comprehension is of utmost importance. Moreover, the construction of your investment portfolio hinges entirely on your comfort level, which we cultivate through education and guidance.

You have the option to opt for a conservative investment approach or embrace a portfolio with a greater emphasis on growth assets.

We want to highlight that THOUSANDS OF Australians are benefiting from financial advice each year WITHOUT incurring any out-of-pocket expenses.

Don’t let your financial aspirations slip away; secure your video strategy session now to discover how you can do the same.

Consider this straightforward query: Are the individuals you’re conversing with providing you with well-informed guidance, or are they merely sharing their opinions?

Are they engaged in their work out of choice, or out of necessity? What assets have they successfully acquired?

In essence, refrain from merely following the crowd. Take proactive steps now to make an informed decision and embark on your unique journey.

Reflect on your circle of family and friends. Have any of them ever engaged with a Senior Financial Advisor?

Examine which among them are actively pursuing their careers by choice rather than necessity. It’s a fact that people are unaware of what they don’t know.

Frequently, individuals postpone critical financial decisions because they grapple with uncertainty about whom to consult, where to initiate their journey, and whom to place their trust in.

We take pride in being one of Australia’s most rapidly growing financial planning enterprises, operating under the esteemed national licensee group, Lifespan, renowned for its rigorous compliance and advisory protocols. Lifespan holds a distinguished position as one of the largest licensee groups in Australia, having received numerous accolades as the best licensee group in the country over the years. For further substantiation of these achievements, we encourage you to visit their website.

It’s important to note that every Anchor Wealth plan undergoes a thorough evaluation by Lifespan before being presented to our valued clients. Once Lifespan is fully satisfied with the quality of advice and recommendations, Anchor Wealth financial planners are granted the green light to share the plan with clients. This rigorous screening process serves as an additional layer of security, greatly reassuring most of our clients.

Moreover, if you peruse the testimonials below, you’ll find an array of positive client reviews. Additionally, our very own Milad Rezaei has earned recognition on the “Best Financial Planners” Australia website.

We’re here to dispel the notion that embarking on an investment journey necessitates a pre-existing background in Investments or an extensive knowledge base. This belief is akin to suggesting that one must possess partially the skills to build a car before driving it, or that they should be proficient in house construction before residing in one.

Our aim is to guide you through the fundamental principles of investing, elucidating the origins of its benefits, and providing you with a comprehensive understanding of its pivotal aspects.

We handle the intricacies and mechanisms behind investing, leaving you free to pursue your life without being bogged down by the complexities of the process.

We want to emphasize that our investment structures are designed with flexibility in mind. With our approach, investors can easily contribute, withdraw funds, pause contributions, and even close their accounts within just a few business days, all without incurring any penalties.

We recognise that life’s circumstances are ever-changing, and our system can be seamlessly tailored to accommodate your current financial situation. We understand the futility of having your funds locked away, and we are committed to providing you with the accessibility and control you need.

We offer comprehensive support and take care of the implementation process, freeing you to focus on your bustling daily life. Your responsibility is limited to grasping the advantages and fundamental principles, which we convey through multiple video and phone calls as needed. Notably, unlike many financial planning firms, we do not levy extra service fees for implementation, ensuring complete transparency and eliminating any unexpected charges.

Indeed, the prerequisites for commencing an investment portfolio can fluctuate among various product providers, especially between regular master trust investment accounts and wrap investment accounts. However, based on our experience, there are specific providers we’ve engaged with in the past who permit individuals to embark on their investment journey with a modest initial contribution as low as $1,000.00.